Healthcare

Rate Reality Check: How Capital Women's Care Stacks Up Against the Competition

.png)

Part 2 of our investigation into the Capital Women's Care vs UnitedHealthcare contract dispute

While Capital Women's Care (CWC) battles UnitedHealthcare over contract terms, a deeper look at Maryland's OBGYN market reveals a complex competitive landscape where negotiated rates vary dramatically across providers and procedures. By analyzing price transparency data from both UnitedHealthcare and CareFirst BlueCross BlueShield, we can see exactly what each insurer pays CWC's competitors. The results are eye-opening.

The Players in Maryland's OBGYN Market

Our analysis focuses on four OBGYN providers in Maryland that have contracts with both UnitedHealthcare and CareFirst. These four practices were selected as a representation of the broader market because they have published rate data with both insurers, allowing for direct comparisons. However, Maryland's OBGYN landscape includes dozens of additional providers, from solo practitioners to hospital-based practices, each with their own negotiated rates that may follow different patterns.

The four providers in our analysis include:

- Capital Women's Care - The large practice at the center of the UHC dispute, with multiple locations across the region

- St Paul Place Specialists (Mercy Medical Center) - Baltimore-based OBGYN practice with established market presence

- Maryland Physicians Edge - Women's health group with OBGYN services, now part of Advantia

- Simmonds, Martin & Helmbrecht - Established OBGYN practice, also under the Advantia umbrella

The four-provider sample provides valuable insights into competitive dynamics among major market players and helps contextualize the CWC-UHC dispute within broader industry patterns.

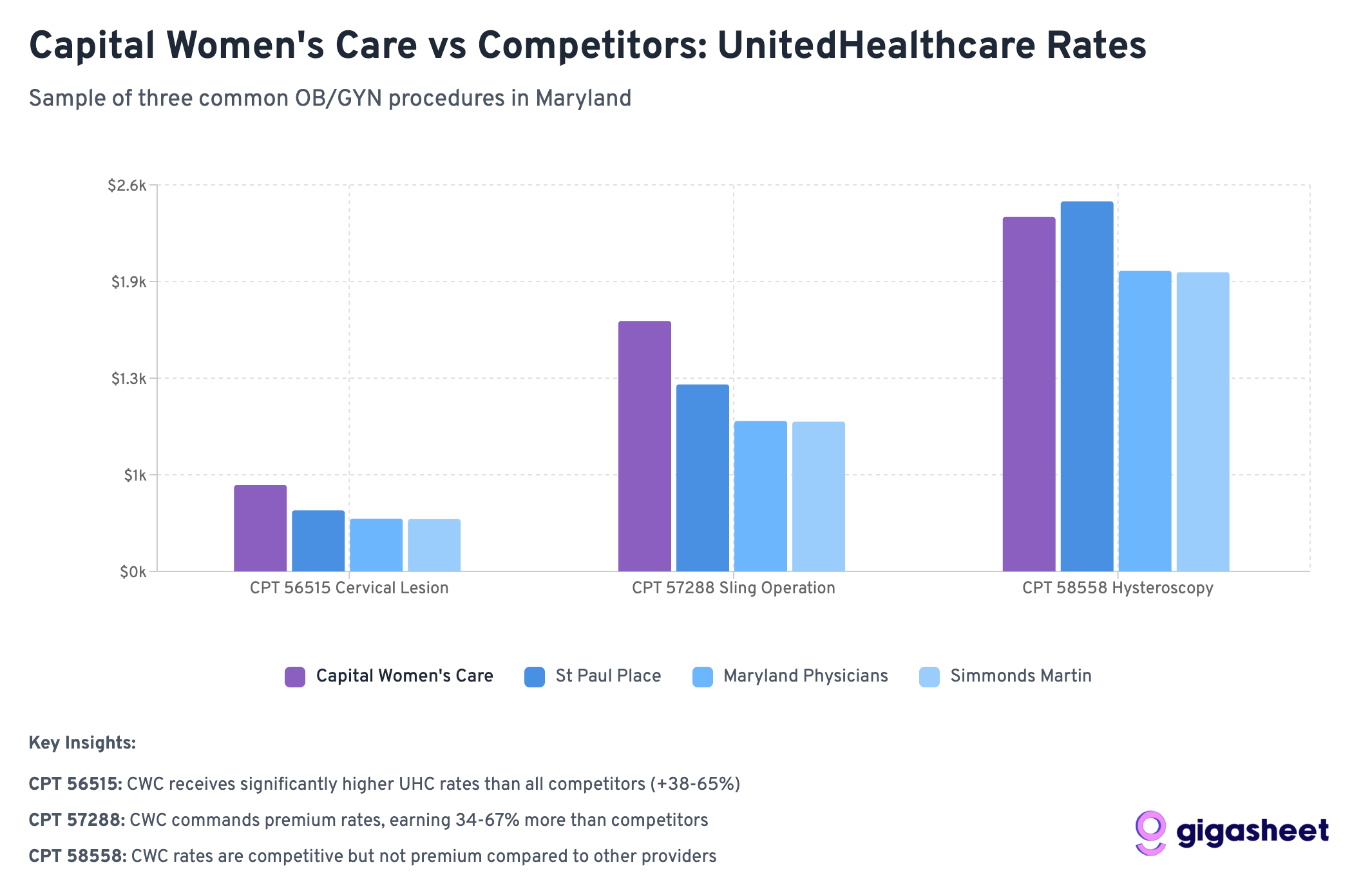

Following our analysis in Part 1, we examined negotiated rates for three common gynecologic procedures:

- Code 56515: Destruction of cervical lesion (treatment following abnormal Pap smears)

- Code 57288: Sling operation for stress incontinence (surgical procedure)

- Code 58558: Hysteroscopy with sampling (diagnostic procedure for abnormal bleeding)

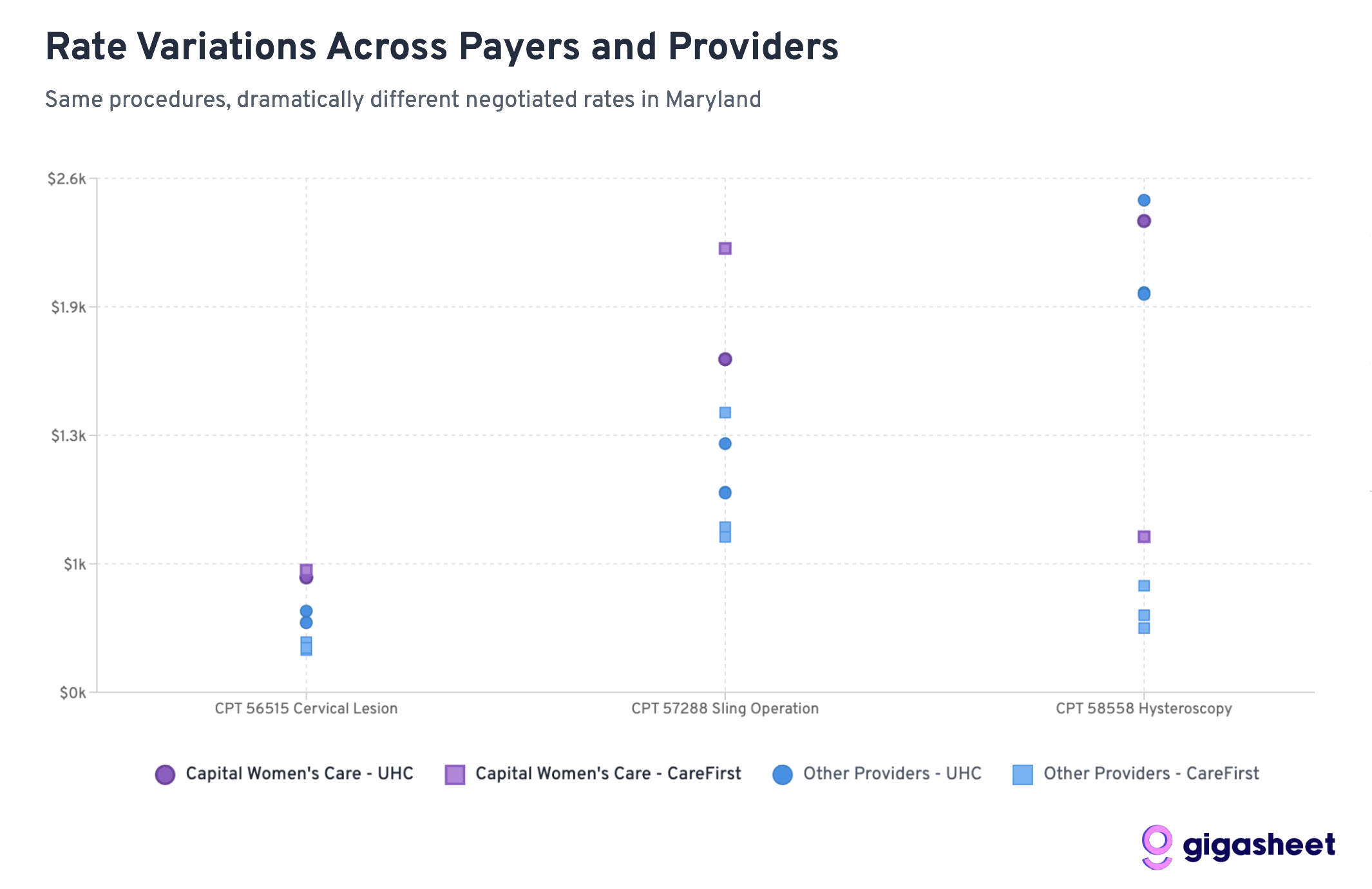

The Rate Comparison: UHC vs CareFirst

Rate variations in the price transparency data reveals a complex competitive landscape where UHC pays 200-500% more than CareFirst for hysteroscopy procedures across all providers in our sample, while Capital Women's Care shows mixed positioning. Sometimes Capital Women's Care commands premium rates from UHC (codes 56515, 57288), other times they're receiving comparable rates to smaller competitors (code 58558). The data suggests both sides in the CWC-UHC dispute have legitimate arguments: CWC already receives competitive or premium compensation, while rate inconsistencies across procedures indicate room for negotiation.

Key Findings: A Tale of Two Insurance Strategies

UHC Generally Pays More Than CareFirst

Across 12 provider-procedure combinations, UnitedHealthcare pays higher rates than CareFirst 75% of the time. This suggests CareFirst has been more aggressive in negotiating lower rates across the Maryland market.

Hysteroscopy Shows the Most Dramatic Differences

For Code 58558 (hysteroscopy with sampling), the rate differences are staggering:

- UHC pays 203-519% more than CareFirst across all providers

- Average UHC rate: ~$2,200 vs CareFirst rate: ~$510

- This represents the largest systematic difference across procedures

Capital Women's Care Commands Premium Rates

CWC's rates relative to competitors reveal why UHC may be resistant to further increases:

- Code 58558: CWC's UHC rate ($2,384) is already comparable to competitors, despite CWC's larger scale

- Code 56515: CWC gets slightly better terms from UHC ($581) vs competitors ($352-411)

- Code 57288: CWC receives significantly higher rates from UHC ($1,685) vs most competitors ($1,008-1,258)

Wide Rate Variations

The most extreme example: Simmonds Martin & Helmbrecht receives 519% more from UHC than CareFirst for hysteroscopy procedures (a difference of nearly $1,700 per procedure). These patterns suggest that while some procedures have established market rates, others (particularly diagnostic procedures like hysteroscopy) lack standardized pricing, contributing to the complexity of provider-insurer negotiations like the CWC-UHC dispute.

What This Means for the CWC-UHC Dispute

CWC Already Commands Premium Rates

The data reveals a key insight: Capital Women's Care isn't necessarily getting unfair treatment from UHC. In fact, CWC often receives higher rates than competitors from both insurers:

- For hysteroscopy (58558), CWC gets comparable UHC rates despite being a larger practice that should theoretically have less negotiating leverage

- For cervical procedures (56515), CWC receives 40-65% higher rates from UHC than smaller competitors

- For sling operations (57288), CWC's UHC rate ($1,685) significantly exceeds most competitors

This pattern suggests UHC's resistance to further rate increases may be economically rational rather than punitive.

Industry-Wide Rate Fragmentation

The massive variations between UHC and CareFirst rates across all providers highlight fundamental pricing inefficiencies in healthcare. However, within each insurer's network, CWC consistently commands premium rates, suggesting their market position is already strong.

Scale vs. Negotiating Power

Conventional wisdom suggests larger practices should receive lower per-unit rates due to volume efficiencies. The data shows the opposite: CWC often receives higher rates than smaller competitors, indicating they've successfully leveraged their size for premium pricing rather than volume discounts.

The Broader Market Dynamics

CareFirst's Market Power

CareFirst BlueCross BlueShield appears to have leveraged its position as Maryland's dominant insurer to negotiate significantly lower rates across the board. With roughly 50% market share in Maryland, CareFirst can drive harder bargains with providers who can't afford to lose access to half their potential patient base.

UHC's Perspective Becomes Clearer

UnitedHealthcare's position in the dispute gains context when viewed against competitor rates. UHC is already paying CWC premium rates compared to other Maryland OBGYN providers. From UHC's perspective, further rate increases would create an even larger gap between what they pay CWC versus smaller practices.

The Economics of Provider Consolidation

The data illustrates a key tension in healthcare consolidation: large practices argue their size justifies higher rates due to quality and convenience, while insurers worry about paying premium prices for what should be commodity services. CWC appears to have successfully established premium pricing, making UHC's resistance to further increases economically understandable.

Looking Forward: What This Means for Healthcare Costs

The Price Transparency Revolution

This analysis is only possible because of federal price transparency requirements that took effect in 2021. For the first time, we can see exactly what insurance companies pay different providers for the same services, revealing the massive hidden variations in our healthcare system.

Market Efficiency Questions

The data raises fundamental questions about market efficiency:

- Why does the same procedure vary by 500% between insurers at the same provider?

- Are patients getting better care when insurers pay more, or are some insurers simply paying inflated rates?

- How can patients make informed decisions when rate variations are this extreme?

Regulatory Implications

These findings may attract regulatory attention, particularly around:

- Whether rate variations this extreme serve any legitimate purpose

- How to ensure patients aren't penalized for insurance-provider rate disputes

- Whether price transparency alone is sufficient to drive market efficiency

Conclusions: Both Sides Have Valid Arguments

The Capital Women's Care vs UnitedHealthcare contract dispute becomes more nuanced when viewed through competitive rate data. Our analysis reveals that both sides can point to legitimate evidence supporting their positions:

Capital Women's Care's Case:

- Rate Inconsistencies: For some procedures like hysteroscopy (58558), CWC receives similar UHC rates to much smaller competitors, despite CWC's larger scale and presumably higher overhead costs.

- CareFirst Comparison: CWC's significantly higher rates from CareFirst for certain procedures (like sling operations at $2,245 vs UHC's $1,685) suggest room exists for UHC rate increases.

- Market Position Justification: As Maryland's largest OBGYN practice, CWC can argue their scale, convenience, and comprehensive services warrant premium compensation.

UnitedHealthcare's Case:

- Already Premium Rates: Across multiple procedures, CWC receives higher rates from UHC than smaller competitors (40-65% higher for cervical procedures), indicating UHC already recognizes CWC's value.

- Economic Reasonableness: Further rate increases would create an even larger premium gap between CWC and other providers, potentially making UHC's network economics unsustainable.

- Mixed Performance: The inconsistent pattern across procedures suggests CWC's premium positioning isn't uniformly justified across all services.

The Complexity of Healthcare Negotiations:

Rather than a clear case of unfair treatment, the data reveals the inherent complexity of healthcare rate negotiations. Both parties can legitimately point to specific procedures and comparisons that support their position, while the overall picture remains genuinely mixed.

This analysis suggests the dispute reflects broader challenges in healthcare pricing: How do you fairly compensate scale and market position while maintaining reasonable cost structures? The competitive data shows there's no obvious "right" answer; just different ways to interpret the same complex market dynamics.

The real insight isn't that one side is clearly right, but that healthcare rate negotiations involve legitimate competing interests where reasonable people can look at the same data and reach different conclusions about fair compensation.

This analysis is based on a sample of price transparency data filed by UnitedHealthcare and CareFirst BlueCross BlueShield, as mandated by federal regulations. The rate calculations are aggregations of data from multiple contracts and locations within each provider organization. To expand our rate analysis from Part 1, we resolved EINs to organization names using public data sources.

The ease of a spreadsheet. The power of price transparency.

.png)